Our workshops are tailored to each company’s requirements, ensuring you and your team get the most out of it, at a fixed price.

One previous attendee said the workshop was: “Vital to anyone working in a commercial or project management role in construction, to understand the workings and thinking of main contractors today.”

The Power of Adjudication in the Right Hands Subcontractors often contact us only after months of wasted time and energy trying to get a Main Contractor to pay them - for Variations, for works completed, for extended prelims, or to release unjustified contra-charges or other deductions. They are usually extremely frustrated and often angry. And rightly so. Many Subcontractors even find that they can no longer even get hold of the Main Contractor’s staff who were previously so keen to talk to them about getting the work done. They are getting nowhere and in the meantime their cash remains in the Main Contractor’s hands. Our Subcontractor Clients tell us that their best decision was to call us rather than make another time-wasting call to the Main Contractor’s QS, who never answers anyway. Main Contractors don’t ignore our correspondence, they know that they can’t, because we have the power of adjudication up our sleeve, to deploy quickly and effectively on behalf of our Subcontractor Clients. And we have the experience required to obtain the best result for Subcontractors, at the minimum cost. A recent case for one of our Clients, a specialist Joinery Subcontractor, successfully addressed his inability to obtain payment of over £200,000 of contra-charge deductions from his account. Before our appointmant, the Main Contractor was adamant that he was entitled to keep all of this money, and wouldn’t entertain any of the Subcontractor’s efforts to resolve matters. However, once the Subcontractor made the wise decision to call RJH, we had his case in Adjudication within a week, and obtained an Adjudication Award for him within just over a month. The Adjudicator awarded our Subcontractor Client every penny of his £200,000+ by the way. The Subcontractor not only recovered his money, but also his valuable time which he can now direct towards running his business. And now he involves us from pre-contract stage to ensure that the risk of this happening again is minimised.

As a Subcontractor in construction, it is highly likely that you are only too familiar with the problem of contra-charges and other unjustified deductions from your account. The Main Contractor just takes your money as he likes and you feel powerless to do much about it. The following short story might resonate with you and also provide you with the answer: Phone a friend.

Every project and problem is different. Yet in all the years we’ve spent supporting Subcontractors, there are some common issues that come up time and time again. As a Subcontractor in construction, it is highly likely that you are only too familiar with the these challenges, and causes of problems on your projects. We’ve highlighted the 20 most common commercial problems which we find that subcontractors struggle with, despite doing a great job on site and being experts in their trade. You can download them here:

Are you aware of the new reverse charge VAT rules coming into force from March 2021? 1st March 2021 will see the new reverse charge VAT rules for the construction industry being brought into force . Please contact Amanda amanda@rjhconsulting.co.uk if you would like us to send you some useful resources to guide you through the process, including: • Flowchart for PAYING A SUBCONTRACTOR • Flowchart for SUBCONTRACTORS • Sales invoice example taken from HMRC’s website NOTE: it is important to add the wording with regards to the reverse charge on your own invoice. What do you need to do? The new legislation has been brought in so that Subcontractors will no longer charge VAT to Contractors who are not end users of the subcontracting services they receive. The rules only apply to work carried out under the construction industry scheme (CIS) where both supplier and buyer are VAT and CIS registered. Are you a Subcontractor (supplier) who is NOT working for an end user? If you are VAT registered and carrying out work for a Building Contractor who is VAT registered and registered under CIS, you will no longer charge any VAT to the Contractor on your sales invoices – neither the labour nor materials. The vital points are that you are: 1. working for a CIS registered Contractor as a Subcontractor; and 2. both you and they are VAT registered. All these conditions must be met for the reverse charge to apply and VAT must no longer be charged. Do you employ sub-contractors under CIS as a contractor (buyer) and are NOT an end user? If you are VAT registered and so are your Subcontractor, they must no longer charge you VAT. Who is an end user? Contractors and Subcontractors will charge VAT as usual to end users, such as a domestic homeowner for whom you are building an extension or a manufacturer for whom you are building a warehouse. The Homeowner is neither a Contractor nor VAT registered, so a normal VAT invoice would be raised. The manufacturer may be VAT registered but is not a Contractor, so a normal VAT sales invoice would be raised. You do not need written notification they are an end user where it is obvious but always ask, just in case. It is possible for an end user to be VAT registered and CIS registered and, in this case, the reverse charge does not apply, VAT must be charged by the Subcontractor. This would occur if the end user employs you as a Subcontractor and there is no onward supply of yours or their building services. An example of an end user who is both CIS and VAT registered might be a housing developer building homes to sell on. You will need some sort of written notification (letter/contract/email) from your customer (the Contractor) to state that this is the case. If they are an end user, you must charge VAT. It is likely that large developers will have a good knowledge of the rules and will automatically guide you on how to bill them appropriately. CIS deductions The new VAT rules do not affect CIS deductions. They remain exactly the same as before with tax deducted from the sales invoice labour amount after VAT has been deducted. Where an invoice has no VAT added to it, the sales invoice total is now obviously the net amount for deductions purposes. Please contact Amanda amanda@rjhconsulting.co.uk if you would like us to send you some useful resources to guide you through the process, including: • Flowchart for PAYING A SUBCONTRACTOR • Flowchart for SUBCONTRACTORS • Sales invoice example taken from HMRC’s website NOTE: it is important to add the wording with regards to the reverse charge on your own invoice. RJH Commercial Consulting is sharing this HMRC information as a guide and for information purposes only, this document does not constitute advice or recommendations, please visit the HMRC website for full details.

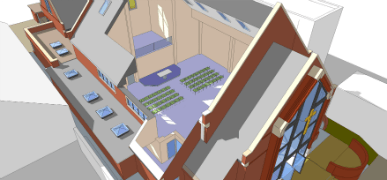

“There has been a very welcome understanding from RJH of our unique funding condition which has necessarily changed the order of approach for the project, that a regular project might not reflect. RJH also has a robust approach defending our position and achieving our objectives when dealing with all the contractors, quietly and effectively invoked. We also have comfort that there is experience in dispute resolution which should prevent out project requiring those services, and we have benefited from the consistency of working with one person throughout.” – Richard Mole. Project Co-Ordinator, Trustees of Driffield Methodist Church